PowerPlus™ Checking

Earn up to $745*!

Elevate Your Earnings

PowerPlus Checking offers rates up to 8.00% APY*, nearly 99 times higher1 than rates at national big banks.

| |

|

|

Limited-time on balances up to $15,000 |

Limited-time on balances up to $15,000 |

| Benefits | |

|

4.00% APY* on balances up to $15,000 |

1.00% APY* on balances up to $15,000 |

|

0.01% APY on balances over $15,000 |

0.01% APY on balances over $15,000 |

|

Up to $20 per month in ATM fee refunds* |

Up to $10 per month

in ATM fee refunds* |

| Monthly Qualifications | |

| $3,000 made via direct deposit or Deposit Anywhere | $1,000 made via direct deposit or Deposit Anywhere |

| 30 qualifying transactions | 15 qualifying transactions |

| Enroll in eStatements | Enroll in eStatements |

Why BCU?

Unlike a bank, the Credit Union is a not-for-profit organization, dedicated to empowering your discovery of financial freedom. That’s why you’ll find better rates, fewer fees (and no fees when possible), higher earnings, and more innovative products and services than you’d get at other financial institutions.

BCU is one of the nation's Top 100 credit unions, serving over 360,000 members in the United States and Puerto Rico. You’re just moments away from a better way to bank. Join today!

Calculate Your Dividends

See how much you could earn

Actual earnings will vary, based on balance amount and monthly qualifications. Level 1 earnings are at 1.00% APY and Level 2 at 4.00% APY.

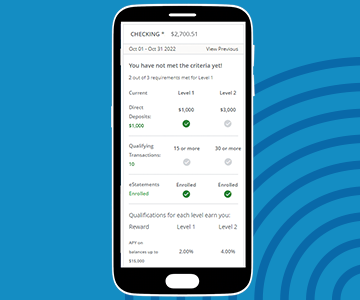

Qualifications Checklist

Easily track your qualifications progress within Digital Banking with the PowerPlus™ Checking Tracker Tool.

Direct Deposit: Make at least $1,000 in direct deposits for Level 1 and $3,000 or more for Level 2.

Qualifying Transactions: Make 15 qualifying transactions for Level 1 and 30 for Level 2.

eStatements: Sign up for paperless statements in Digital Banking.

Support Videos

Frequently Asked Questions

-

What is a qualifying transaction?

Qualifying transactions include BCU debit or credit card purchases, online bill payments, ACH payments or payments to BCU loans.

-

What is the introductory offer?

Memberships opened with a PowerPlus Checking between July 1, 2024 – December 31, 2025 will automatically receive the introductory offer. During the introductory period, Level 1 will earn 4.00% APY and Level 2 will earn 8.00% APY on balances up to $15,000. The account must meet all requirements to achieve either Level 1 or Level 2 for all three months to be eligible to receive the respective higher APY.

-

Is there a penalty if I don't meet the qualifications?

If you don't meet the qualifications, don't sweat it. You won't be penalized, and will continue to enjoy no minimum balance requirements or monthly maintenance fees as well as easy access to your account.

-

Will BCU inform me of what level I qualify for?

For the most current information on your level qualification status, please log into Digital Banking and navigate to the PowerPlus™ Checking tool on your Dashboard.

-

How do i switch my direct deposit?

The Switch Direct Deposit tool in Digital Banking removes the hassle of contacting your employer. Learn more.

-

How do I go paperless and enroll in eStatements?

First, log into Digital Banking. From your Dashboard, select Menu, then View Documents. Then, select Paperless Settings and checkmark all or “Statements” to qualify. Go green to get the green!

-

What if my direct deposit fluctuates monthly?

We’ve got you covered. We’ll review your direct deposit requirement on a monthly basis, and you may fluctuate from Level 1 or Level 2 automatically. If depositing a check from another financial institution is an option via Deposit Anywhere, this qualifies, too

. -

What if I no longer qualify to earn a dividend?

Whether or not you qualify for a level and earn a dividend, you will not be charged a minimum deposit or monthly maintenance fee. We’re here to help you earn to your highest potential. Call us at 800-388-7000 or schedule an appointment with one of our certified Goal Consultants to determine opportunities for you to save or earn more.

-

Disclosure

PowerPlus™ Checking

*Membership must be opened between 7/1/2024 and 12/31/2025 to receive this promotional offer. The 3-month introductory period begins the month the membership is opened and ends on the last calendar day of the 4th month. During the 3-month introductory period Level 1 will earn 4.00% APY and Level 2 will earn 8.00% APY. After the 3-month introductory period, balances up to $15,000 will earn the stated higher rate and the portion of the balance over $15,000 will earn the stated lower rate. See rate sheet or website for current rates. The member account must meet all requirements to achieve either Level 1 or Level 2 for all three months to be eligible to receive the respective higher APY.

To earn monthly dividends and reimbursements of other banks’ ATM surcharge fees up to $20.00 per month, your account must meet all three of these requirements to qualify for Level 1 or Level 2. Please note, Level 1 ATM surcharge fees are covered up to $10.00 per month and Level 2 ATM surcharge fees are covered up to $20.00 per month.

To achieve Level 1, you must have monthly direct deposits totaling at least $1,000 into your PowerPlus Checking account on an ongoing monthly basis, enrollment in eStatements and completion of at least fifteen (15) qualified transactions.

To achieve Level 2, you must have direct deposits totaling at least $3,000 into your PowerPlus Checking account on an ongoing monthly bases, enrollment in eStatements and completion of at least thirty (30) qualified transactions.

Qualified transactions include any combination of the following: BCU Debit Card PIN, Debit Card Signature, credit card purchases, Online Bill Pay or ACH payments, which will apply toward the monthly requirements in the month they post to your account. Credit card transactions that post on the last day of the month will be applied toward the following month’s transaction total. Accounts not meeting all monthly requirements will not earn dividends and will not receive reimbursements of other banks’ ATM surcharge fees and will not be eligible for the increased APY offer during the introductory period.

Rate accurate as of 7/1/2025. The dividend rate and annual percentage yield (APY) may change at any time. Balances up to $15,000 will earn the stated higher rate and the portion of the balance over $15,000 will earn the stated lower rate. See rate sheet or website for current rates. There is no minimum balance required to earn dividends. Dividends are paid monthly and calculated based on the average daily balance method. Fees may reduce earnings.

PowerPlus Checking is available as a personal account only and is limited to one account per member. When Opted In, if you do not have sufficient available funds in your checking account to clear a presented item, funds may automatically transfer from your savings or money market share and may count towards withdrawal limitations for that savings or money market share (Electronic funds transfers from savings and money market shares, which include overdraft transfers are limited to six per month). Each electronic funds transfer in excess of six per month is subject to a $3 excessive withdrawal fee. See Service Charge and Fee Schedule in Consumer Member Service Agreement for further details. PowerPlus™ Checking is a trademark of BCU.1Calculation is based on the national deposit rate for interest checking of 0.07 as of 6/16/2025. Source: S&P Capital IQ Pro; SNL Financial Data. Calculations: FDIC. Visit FDIC: National Rates and Rate Caps to access published information.

2 Direct deposit allows you to receive payroll and other electronic deposits up to two days ahead of your scheduled payday. It’s important to note, funds are not AVAILABLE for you to spend until they are reflected in the AVAILABLE BALANCE. Please be sure to confirm available funds in your account before withdrawing against this deposit. While BCU will try whenever possible to advance payroll direct deposits by up to 2 days, availability of funds ahead of the original scheduled pay date is not guaranteed. You should not rely on direct deposit to satisfy the needs of scheduled bill or loan payments, or any other date-sensitive financial obligations.

3 U.S. checking or savings account required to use Zelle. Transactions between enrolled users typically occur in minutes and generally do not incur transaction fees.